Know Your Options When It Comes To Choosing The Right Health Insurance Plan

Insurance, irrespective of the type, exists for one single reason. To provide you financial cover during catastrophic events. Saving you hundreds of dollars in the bargain. When you buy a health insurance plan, you shouldn’t let this basic insurance principle slip of your mind.

Also keep in mind that your health insurance will only kick in when your deductible amount and out of pocket expenses are met.

We are going to use certain terms which you might be aware off or you need explanation. Like

Health Insurance Premium: This is the amount which you pay monthly, semi-annually or annually against your health benefits as defined in your health insurance plan.

Co payments: This is a pre-decided fixed dollar amount which you need to pay against specific medical services like weekly doctor visits and prescribed medicines.

Deductible: This is an amount which you pay once every year before your health insurance starts paying you for the benefits. If you want lower monthly premium then you can do that by increasing your deductible amount. For more details on deductible concept, read our article on high deductible health insurance plans.

Co-Insurance: This is an amount which is paid by you for the medical services covered by your health plan after you have met your deductible amount.

Out Of Pocket Maximum: The total amount which is to be paid by you on annual basis before your health insurance takes over.

Even before you decide on the type of health insurance plan, you need to first decide on two important factors. These are your affordability (how much you can conveniently pay towards premium) and your needs (what health benefits you are looking for in a health plan).

Important Scenario: Many individuals who are employed get stuck when they are searching for the right health insurance plan. Reason being, their pre-conceived notion of going for the same health plan which they had from their employer. Such health plans are expensive in the outside world.

A Step By Step Plan To Choose The Right Health Insurance Plan

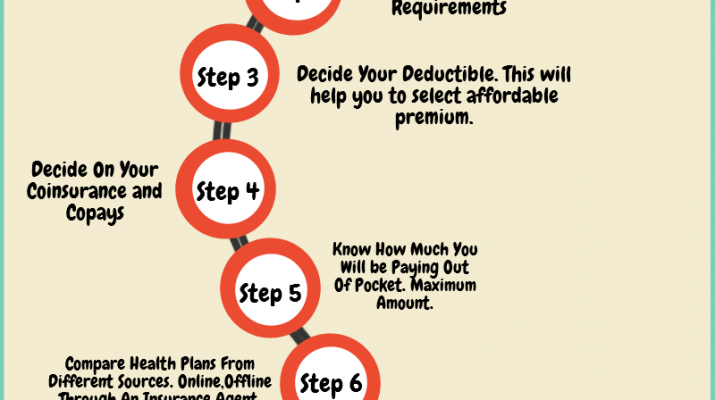

Before we get into the nitty gritty of choosing the health insurance plan, let us summarize what we are going to discuss coz time is valuable and we need instant and precise information. So if you don’t wish to read the full article then here is your 10 step guide to follow and select the best health insurance option for yourself or your family.

The above picture is kind of a mind map to streamline your process of choosing the right health insurance plan for you. There are thousands of options at your disposal and each health plan is designed because there was and is a specific need for it. The structure of every health plan might be different from each other however you should be able to differentiate between

HMO (Health Maintenance Organization) Vs PPO (Preferred Provider Organization)

The difference between HMO and PPO is covered. Just to highlight some difference between a PPO and HMO. PPO will offer you much higher level of reimbursement. PPO will consists of a network of doctor’s and medical facilities which have a contract with the health insurance company to offer medical treatment at discounted rates.

HMO works in a little different way where the liberty of choosing the doctor is quite limited in nature. The most common and known example of HMO is Kaiser Permanente. These plans are less expensive when compared to a PPO.

After You Have Chosen A Health Plan Structure Between HMP and PPO…

Once you decide between a HMO and a PPO, you will then come to a point where decision is to be made regarding which health plan to go for within that structure. The primary differentiating factor boils down to choosing between a copay health plan or health savings account.. HSA and a copay has their own pro’s and con’s which might suit some and might not favor some individual needs. Hence, they are not a one size fit all solution.

Most of us in our quest of finding the right health insurance plan choose either a HSA plan or a copay.

Having said that, there are other options available which might suit your requirement. These are:

- Indemnity Health Insurance Plan

- Short Term Health Insurance, and

- Limited Health Insurance Plan

Health Savings Account: A complete overview of health savings account is covered. If you wish to have the right amalgamation of low out of pocket maximum along with affordable premium then HSA could help you achieve both the objectives. One important aspect to highlight here is that if you don’t want any coinsurance included in your health plan then your maximum out of pocket amount will be the deductible you choose.

Free Of Cost Preventive Care Services: Preventive care services are absolutely free if you have purchased health insurance after March 23rd 2010.

When Should You Choose A Copay Plan?

A copay plan is suitable for those who frequently visit their doctor for medical reasons. Ideal scenario would be 5 to 6 visits in a year or more. Generally, the copay amount is low between $25 to $50 but if you multiply the amount for each visit with the total number of visits then it is a large chunk of money which you are paying. Copay generally depends on the benefits which you are getting from your health plan and if you are visiting a doctor within the health insurance network. If don’t need to visit a doctor frequently then it is fine to choose a plan without a copay to save money.

Do not get confused between copay and coinsurance. Copay is a fixed dollar amount paid before you meet your deductible. Coinsurance is a percentage which you may be required to pay after you meet your deductible.

Choose Your Deductible Wisely…

This is tricky. Affordability is again a factor here. If you have a health plan currently then it is wise to revisit your previous record and check how many times you didn’t meet your deductible? Moreover, also check how much you could have saved if you had chosen a high deductible plan. Play a balancing act between your deductible, monthly premiums and your needs.

I hope you get the best out of this information along with the article links mentioned here.