Food For Thought: Off lately, there has been a lot of discussion on the cost of long term care insurance and primarily on the gender basis where cost for single women is all set to take a steep jump by 40% upwards. A long term care insurance can be bought in different ways. You have the option of buying a standalone long term policy or buying a combination of life insurance product with a long term care rider. In fact there is a third option as well, buying long term care annuities? In my previous article I mentioned the rising cost of long term care which unfortunately stops many individuals from buying it. Should you buy it in the first place? Read that article for further information. So is there a way we can dilute the expensive affordability of long term care insurance and still have it? Yes, there is.

Consider the following statistics first:

Average Cost Of Annual Expenses In A Private Nursing Home In 2013: $82,000

This account to a daily expense of: $220 each day.

Anyone who has availed the benefits of long term care insurance need around 3 years to recuperate.

Under this scenario, if you wish to receive long term care today it would require a spending of $250,000.

The main concern however does not arise from these high costs. It is the time when you actually file a claim. This is generally is around 15 years from the start of your policy. Now the direct correlation to this aspect is that cost of long term care insurance is increasing at the rate of 5% each year. So as we see that you cannot seclude yourself from paying higher premiums and that to without actually needing the benefits for a long time.

Now, drawing conclusion from all the above mentioned data, a 55 year old would need more than $300,000 in 25 years’ time when he/she turns 80 for long term care expenses. Moreover, a 3 year need would require an expense of over $1 million dollars. This can eat up your retirement savings like a plaque.

Is A Long Term Care Rider On Your Life Insurance A Cheaper Option

This is the main topic of discussion why I did a little math above to determine the cost of long term care insurance in 2013 and beyond. Whether a long term care accelerated rider is a suitable alternative (cost effective) when compared to a standalone long term care policy depends on some factors like:

- How much is your life insurance policy?

- How much will you get as a result of accelerated payout while your policy is still in force?

- Most importantly, what will be the cost of long term care insurance when you actually need it?

I tried to answer all these questions in the calculations above. Now if you do your own calculations you will see that buying a long term care rider on your life insurance policy will not be sufficient for your needs. In fact, the money withdrawn early will further reduce your death benefits and the sense of security which you had for your family members will be a long gone dream.

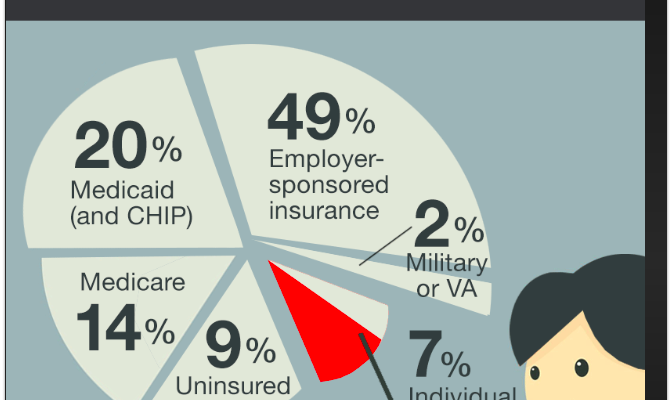

Is Medicare An Alternative To Long Term Care Insurance Rider

A lot of individuals do not understand a simple fact that Medicare is just like another health insurance plan. Medicare and other supplemental Medicare policies do not cover extended chronic care, assisted living expenses and other types of adult day programs. So relying on Medicare to cover long term care expenses is not a wise decision.

Long Term Insurance With Inflation Protection Will Help In Costing

This can be the best alternative for you if you wish to benefit from the rising cost of long term care insurance. Often called as benefit increase rider. As the name goes, each year your long term benefit will increase due to adjust in inflation. If you buy a long term care plan without inflation protection then it will decrease in value. As a result, reducing your coverage each year and making it costlier.

Inflation Protection comes in various types. I will mention them here but will not be covering them in detail in this article.

- 5% simple inflation protection.

- 5% compound inflation protection.

- 4% compound inflation protection

- 3% compound inflation protection

- CPI compound inflation protection

All these options may not cover you for 100% expenses but they will help you to fight the cost when compared to a policy with inflation protection. The type of inflation protection which will suit your need can be answered by your health insurance expert. Consult before you make a final decision.

Long Term Care Insurance With Purchase Option

Before finishing on this article, I want to highlight one more option here which is the purchase option. The main reason for highlighting this is that you shouldn’t confuse inflation protection option with the purchase option. This is suitable for those in their late 70’s and later. In short where the gap between purchasing the policy and filing for a claim is very less. This may be for you because inflation protection will not be of much benefit to you due to less time in policy.